Glendale, California Approves Little To No Cost Solar

Wednesday, February 5, 2020

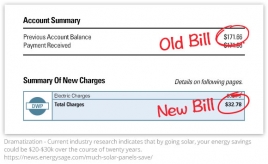

If you're paying more than $99/month for power in California, you might qualify for zero down solar panels. See if your zip code qualifies!

How Does It Work?

The federal solar tax credit, also known as the investment tax credit (ITC), allows you to deduct 30 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value.

Homeowners like you in California can go solar for little to $0 Down with a Solar Lease (PPA) and Save on Your Electric Bill. It's a serious score for homeowners! The best part about determining your potential savings is that there is absolutely no obligation to do anything until you are happy with the savings.

https://articles.comparisons.org/congress-is-helping-state-residents-go-solar-v2-easy-v2.php?aff=1561&sub=MFRB_Solar&pub=&aux=&xcode=e390787f-047c-4f41-a868-83146224af4d&ver=city%20state%20Approves%20Little%20%28VIDEO%29&aff_unique1=